|

|

|

|

|

Are you leaving money on the table by not claiming the tax credits you’re entitled to? Tax credits and incentives were written in the law so that qualifying taxpayers can be awarded for certain activities such as job creation and promoting business growth. Let the IRS and the state revenue agency finance your growth by claiming the tax credits you have missed.

What are tax credit and incentives?

Tax credit is a benefit that IRS and the state revenue agencies allow to the taxpayers based on certain business activities and situations. Tax credit offsets the taxpayer’s tax liability on a “dollar-for-dollar” basis so it can create significant tax savings. A tax credit is better than a tax deduction, which only lowers the amount of taxable income. Therefore, tax credit should not be overlooked by taxpayers who have potential to take advantage of them.Incentive is a general term that encompasses the tax credits, special tax deductions and other tax benefits provided to the taxpayers

Federal Tax Credits

Federal Work Opportunity Tax Credit (WOTC) program rewards taxpayers who are

hiring from certain demographic groups. Federal Empowerment Zone (EZ)/Renewal Community (RC) programs promote business growth in certain economically-distressed areas of the country. Businesses located in the EZ or RC areas earn tax credits by hiring employees from the same federally-designated zone.

California Enterprise Zone Credits

Businesses located in one of the state’s 42 Enterprise Zones can generate Hiring Credit and Sales/Use Tax Credit, which can significantly reduce their California income tax. A single qualifying employee can generate over $37,000 of Hiring Credit for its employer. Also, sales tax paid for machinery, equipment, computers and other qualifying personal assets being used in the “zone” will generate credit. We have clients in the zone all across the state, covering the Northern, Central and Southern California.

Net Interest Deduction

Banks (and lenders) that loan funds to the businesses located in any one of the 42 California Enterprise Zones do not have to pay California income tax on the net interest it earns from the “zone” borrowers. Hutchinson and Bloodgood can quickly review a bank’s loan portfolio to determine the Net Interest Deduction available for the Bank, which brings permanent state tax savings.

Why Hire a Specialist?

| |

|

Many CPAs underestimate the complexities involved in the tax credit area. There are constant changes and expansions to the geographical boundaries of the zones, zones’ effective and expiration dates, and technical complexities that are unforeseen by a general CPA. |

| |

|

There is limited tax law and authorities written for the tax credit - that means an actual working knowledge based on experience and audit result is invaluable. |

| |

|

Speciaists have a streamlined process already set up to efficiently screen a client’s tax credits whereas it often costs a lot more time for a general practitioner to establish his/her system for those few clients who request tax credit service. |

|

Why Hutchinson and Bloodgood?

| |

|

We have built our reputation as a trusted advisor for our clients for over 80 years. Just as our clients come to us to rely on our general tax and accounting services, clients and other CPAs rely on us to deliver the same high-quality work and service in the tax incentive area. |

| |

|

We look out for the client’s interest first, not our own, because we are interested in building long-term business relationships. |

| |

|

We offer flexible fee arrangements and fee options that meet your budget. We make sure our cost is only a fraction of the savings you obtain. |

| |

|

We offer free initial consultations and can often provide potential benefit assessment before you contract with us. |

|

NEWS

In January, 2013, the Department of Housing & Community Development (HCD) has proposed several changes to the California Enterprise Zone program through a set of Proposed Regulations. Here are some of the more significant items being impacted:

- Voucher applications only allowed within 1 year from date of hire.

- Employees hired before the effective date of the proposed regulations will have a 1-year grace period for vouchering.

- Form W-4 no longer accepted for TEA support documentation.

- Increase state voucher fee from $10 to $15.

The Proposed Regulations are scheduled to be adopted within the year, depending on comments received and any revisions being made. We’ll keep you posted on the status of the proposed regulations and any new updates. |

|

Lauren Lee is quoted in the January 31, 2011edition of the San Fernando Valley Business Journal.

Zone Cuts Will Scuttle Firms |

|

Read the article. |

|

Lauren Lee is quoted in the Sept. 27, 2010 edition of the San Fernando Valley Business Journal.

Firms See Opportunity in Enterprise Zone Specialization Business brings in new accounting clients as word gets out about program. |

|

Read the article |

|

| Hutchinson and Bloodgood’s interview with PKF North America on the topic of Federal and State Tax Credits is published in its January 2010 Niche Notes.

|

|

Read the PKF Niche Notes Newsletter |

|

| Hutchinson and Bloodgood teaches two Webinars for PKF North America accounting firms on the topic of Employment Tax Credits in July 2009.

|

|

|

|

| Hutchinson and Bloodgood speaks as one of the panel of experts at Santa Clarita City’s Enterprise Zone Workshop on March 25, 2009. |

|

|

|

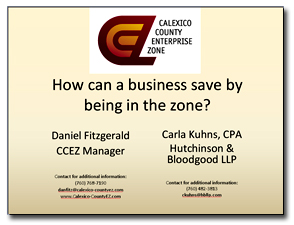

| Hutchinson and Bloodgood, in conjunction with Calexico County Enterprise Zone, presents the California Enterprise Zone workshop to the local businesses on March 4, 2009.

|

|

|

|

| One of Hutchinson and Bloodgood’s clients gets featured in a newspaper advertisement in The Signal for successfully implementing the California Enterprise Zone credits, October 2008.

|

|

|

|

| Hutchinson and Bloodgood, in conjunction with Imperial Valley Enterprise Zone, presents a Enterprise Zone Tax Credit Seminar on March 25, 2006.

|

|

|

| |

|

|

Hutchinson and Bloodgood LLP is a proud member of CAEZ

California Association of Enterprise Zones |

|

|

|

|

|

|

|

|

|